Recent Post

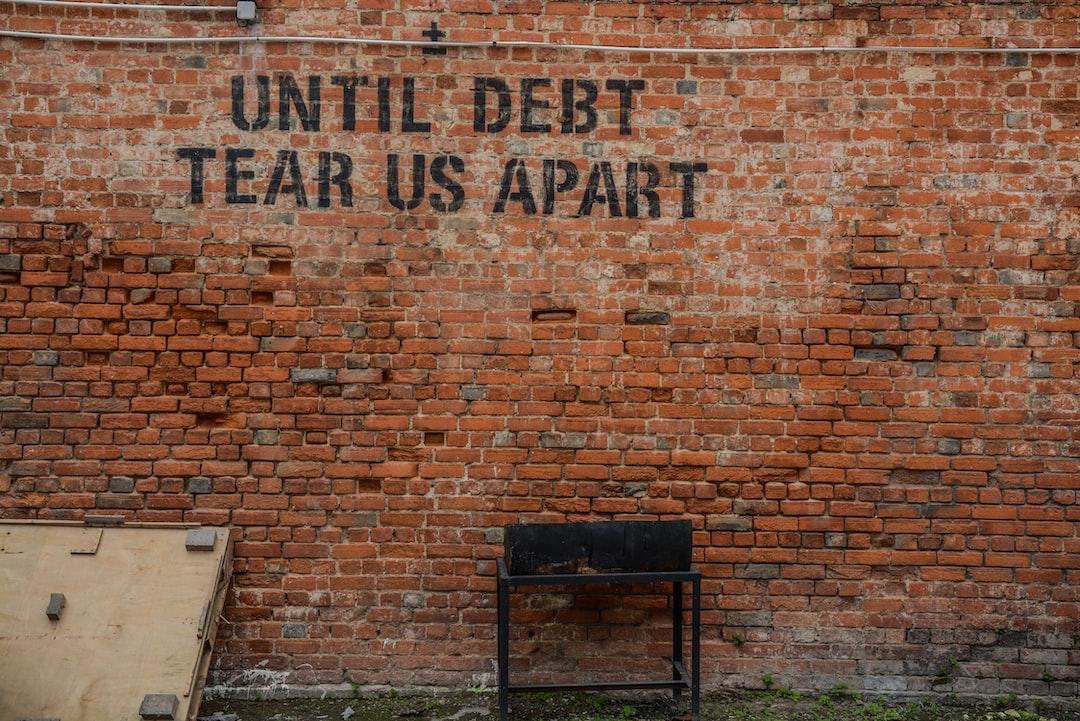

- The Impact of Debt on Relationships and Family Dynamics: How Debt Can Strain Bonds and Shape Lives

- Managing Debt as a Couple: Strategies for Financial Harmony and Relationship Success

- Understanding Debt Settlement: How It Works and What to Consider

- Debt Settlement vs Bankruptcy: Which One Impacts Your Credit Score the Most?

Do You Want Help to Resolve Your Debt?

Hi, We are RiseUp Solutions. We help people overcome their debt and secure their financial future. The question is, will it be you?

Introduction

When individuals find themselves overwhelmed with debt, they often consider debt settlement or bankruptcy as potential solutions. Both options have their own implications, particularly when it comes to credit scores. This article will compare the impact of debt settlement and bankruptcy on an individual’s credit score, providing insights to help individuals make informed decisions about managing their debt.

Debt settlement involves a negotiation process between a representative and creditors, aiming to reduce the amount owed. It is a private arrangement that typically requires individuals to make regular deposits into an escrow account to offer a settlement to creditors.On the other hand, bankruptcy is a legal process that allows individuals to either discharge or restructure their debts. It can be filed under Chapter 7, involving the liquidation of assets, or Chapter 13, which entails a repayment plan over a certain period of time. It is important to note that both debt settlement and bankruptcy are options for consumers who are unable to budget their way out of debt.

When individuals are struggling with debt, it is important for them to understand the differences between debt settlement and bankruptcy. Debt settlement involves negotiating with creditors to reduce the amount owed, while bankruptcy is a legal process that allows for the discharge or restructuring of debts. Both options have their own implications, particularly when it comes to credit scores. By understanding the impact on credit scores, individuals can make informed decisions about which option may be best for their financial situation.

Impact on Credit Score: Debt Settlement

Debt settlement can have a significant impact on an individual’s credit score. When opting for debt settlement, individuals may experience continued collection contacts and the possibility of being sued by creditors. Additionally, there may be potential tax implications associated with the forgiven debt. It is important to consider the pros and cons of debt settlement carefully. On the positive side, debt settlement offers the potential to clear unsecured debt at a fraction of what is owed and avoid bankruptcy. However, it is important to weigh these benefits against the potential negative consequences, including the continued collection contacts, the possibility of being sued, and the potential tax implications. It is also worth noting that debt settlement fees are typically a percentage of the total debt settled.

For example, let’s say an individual owes $30,000 in credit card debt. Through debt settlement negotiations, they are able to settle the debt for $15,000. While this can provide significant relief from debt, it is important to consider the impact on their credit score. The debt settlement process may result in negative marks on their credit report, such as “settled for less than the full amount owed.” These negative marks can stay on their credit report for up to seven years, potentially lowering their credit score and making it harder to obtain credit in the future. Additionally, the individual may still face collection efforts from creditors and potential tax implications on the forgiven debt.

When considering debt settlement as an option, individuals should carefully weigh the potential impact on their credit score. While it can provide relief from debt at a reduced amount, it is important to understand the potential consequences and weigh them against the benefits.

Impact on Credit Score: Bankruptcy

Bankruptcy, whether filed under Chapter 7 or Chapter 13, also has a significant impact on an individual’s credit score. In Chapter 7 bankruptcy, debts are typically erased through the liquidation of assets. This can provide a fresh start for individuals burdened by unmanageable debt and may even lead to potential credit score improvement in the long term. However, individuals need to qualify for Chapter 7 bankruptcy, and there is a potential risk of asset liquidation and a negative impact on credit reports. Chapter 13 bankruptcy involves a repayment plan over a span of three to five years, providing individuals with time to pay back creditors and protect themselves from repossession. However, the long repayment period and the impact on credit scores should be taken into consideration. It is also important to note that both Chapter 7 and Chapter 13 bankruptcies come with their own fees, such as filing fees and charges for credit counseling and debtor education.

For example, let’s say an individual is drowning in debt and decides to file for Chapter 7 bankruptcy. This process involves liquidating their assets to repay creditors and discharge their debts. While this can provide a fresh start and relief from overwhelming debt, it is important to understand the impact on their credit score. Filing for bankruptcy will result in a negative mark on their credit report, which can stay on their report for up to ten years. This negative mark can lower their credit score and make it more difficult to obtain credit in the future. However, over time, as the individual rebuilds their credit and demonstrates responsible financial behavior, their credit score can improve.

When considering bankruptcy as an option, individuals should carefully weigh the potential impact on their credit score. While it can provide relief from overwhelming debt and a fresh start, it is important to understand the potential consequences and be prepared for the impact on their credit score.

Don’t stay stuck in the debt cycle.

Experience the tranquility of a life unencumbered by debt, and the freedom to pursue your dreams.